Hello there,

I am new to the Niyo ecosystem and have been exploring its various features and offerings. I currently have a personal Niyo account; and I am considering setting up additional accounts for different purposes; such as travel and savings. Although; I am a bit unsure about the best way to manage multiple accounts effectively.

How do you structure your accounts? Do you use separate accounts for distinct purposes; or do you prefer to consolidate everything into a single account?

How do you keep track of expenses and budgets across different accounts? Are there any tools or methods within the Niyo app that you find particularly useful for this?

If you have multiple Niyo cards linked to different accounts, how do you manage them effectively; especially when traveling or making online purchases?

What steps do you take to ensure the security of your accounts, especially if you have several? Are there any specific Niyo features or third party tools you recommend for added security?

Also; I have gone through this post; https://community.goniyo.com/t/i-had-an-account-with-sbm-niyo-global-now-i-cannot-access-it-nor-i-can-open-a-new-account-what-to-do-minitab/ which definitely helped me out a lot.

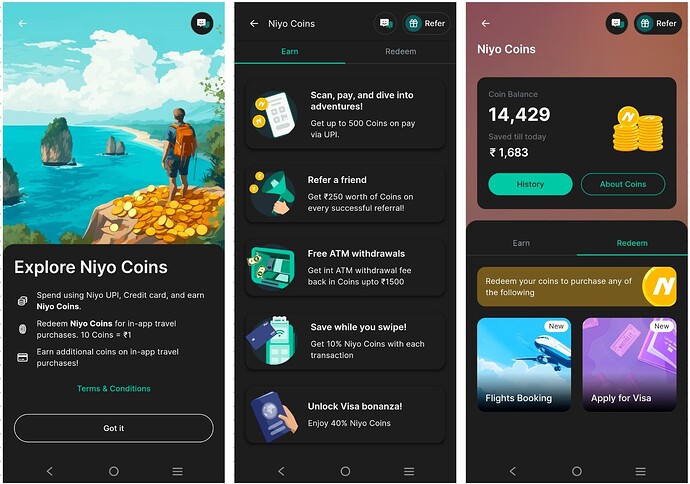

Are there any strategies you use to maximize the benefits or rewards offered by Niyo across multiple accounts?

Thanks in advance for your help and assistance.