Hi,

I manage two Niyo accounts: Niyo DCB and Niyo SBM, along with a Niyo SBM Debit Card, Niyo SBM Credit Card, and Niyo DCB Debit Card. All the information for these accounts is available in the Niyo app and presented in a structured manner. ![]()

Account Usage:

- Niyo DCB Card: I use this for international cash withdrawals.

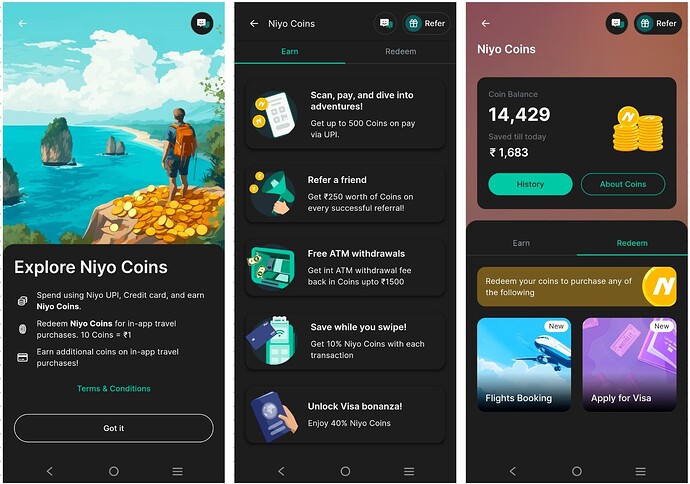

- Niyo SBM Credit Card: I use this card for both international and domestic payments, online and offline. For domestic transactions, it earns 1% cashback in the form of Niyo Coins, which can be redeemed for flights and Visa services (check the Earn and Redeem sections in the Niyo app for details).

Tracking and Budgeting:

- Transaction Tags: The app allows you to categorize transactions (e.g., healthcare

, transport

, transport  , food

, food  ) and customize these categories. This feature helps in tracking and filtering your spending.

) and customize these categories. This feature helps in tracking and filtering your spending.

Benefits:

- Forex Markup: There is zero forex markup on international transactions.

- ATM Withdrawals: You get three free international ATM withdrawals (one per quarter), up to ₹1500.

- Zero TCS: No Tax on international purchases through Niyo SBM Credit Card.

- FREE International Lounge: By spending 50,000 INR abroad, A lounge pass will be unlocked.

Security Features:

- Chip & PIN: For secure swipe transactions.

- Insurance: Your funds are insured up to ₹5 lakh by the DICGC, a subsidiary of RBI.

- Card Management: You can lock/unlock your card, block it if lost or stolen, and reset your PIN through the app.

- 24/7 Support: Access to a dedicated support team for any queries or concerns.

Managing multiple Niyo accounts is streamlined through the Niyo Global app, where you can handle all your accounts and cards in one place. Note that onboarding for Niyo Equitas accounts is currently paused.